Tsp to find A property: Military professionals are acclimatized to high challengesbat trips, deployments, and you may repeated transfers are a couple of the problems they face apparently. This is why be concerned, many army users sense extreme problems with regards to providing in the future financially.

Maybe one of the largest positive points to U.S. bodies otherwise army provider is the Thrift Deals Bundle. The new Thrift Discounts Bundle (TSP) try senior years coupons and you may financing package offered to most recent personnel from this new army and you can national.

Due to the fact its good defined contribution advancing years plan, the senior years money you get regarding Tsp relies upon how much cash your (and your institution, if applicable) lead via your performing ageplus how good the expenditures perform over that time. Though it even offers numerous advantages of later years offers, the newest Tsp try an around-appreciated and you can lower than-made use of work with supplied by the us government.

Becoming a service member gives you use of financial support potential you to civilians never. Which is a neat thing! At the same time, of many solution participants is younger and have not got much authoritative financial studies, thus navigating the new money choices to dedicate is tough. Although often confusing, expenses early is paramount so you can money! I’m sure numerous retired solution players which managed to get a point to begin with very early. It don’t only rely on the later years, and also ordered leasing services when you look at the areas where these were stationed, and you can dedicated to nonexempt accounts. Immediately following twenty years, they were set for life.

As to the reasons Tsp To purchase A home?

When you make investment, this new investment organization is planning to require some of the money just like the a service commission; not one person works for totally free. The new Tsp currently charge a help fee away from 0.04%, that’s even the lowest discover any place in the newest world. Even index financing, and this certain investors claim are the most effective financial investments, as a rule have provider charge twice of up to brand new Tsp. Extremely workplace-backed old age deals arrangements is located at least three to four moments more pricey than the Teaspoon.

The Teaspoon is even a tax virtue. Because Tsp is actually an income tax-deferred otherwise income tax-accredited senior years program, you will be making a take on the fresh new Irs that you will not use this money if you do not was near to retiring. In return, the new Internal revenue service states it won’t taxation your into the a fraction of those funds. This is one of many large offering items of every later years deals plan. That have conventional Teaspoon benefits, you have made a tax crack today and you will spend taxation in old-age. In contrast, you make Roth Teaspoon efforts which have after-tax bucks. Thus, you don’t get a tax split today, but the account expands taxation-totally free usually. In addition, their distributions within the advancing years is income tax-totally free.

Is also a real estate investment become funded having fun with a tsp?

The brand new Teaspoon is going to be committed to a residential property with a few requirements. The actual only real choice is to use the amount of money to have a residential loan, which is a house this package was staying in as the a great no. 1 household. In theory, you can rent out a couple of even more bedrooms, which would meet the requirements a good investment. However, when you are nevertheless working, you happen to be in a position to transfer a few of the Tsp money so you can an enthusiastic IRA otherwise unicamente 401k, and that one another allow for investing a house. When you find yourself retired, the whole Tsp harmony might be transferred.

Borrowing from the bank against the Teaspoon benefits is an easy way to introduce an advance payment and you can settlement costs to suit your investment property. The loan is limited with the financing you have provided for the Teaspoon account not matching money from your own department otherwise services and you can any accumulated money. The borrowed funds matter should be between $step 1,000 and you will $50,000 and you will gets paid down at interest to your G Financing at the time of processing. An excellent $fifty handling fee will get placed into your loan also.

Benefits of Purchasing an investment property which have Tsp

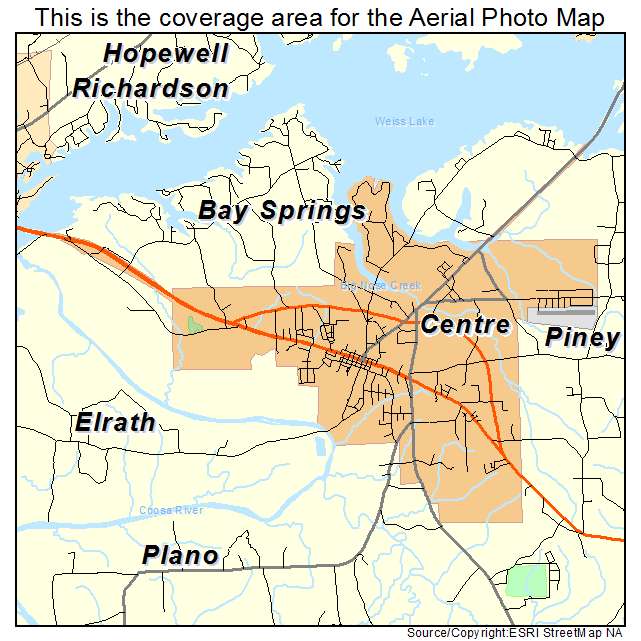

Notice out-of a teaspoon mortgage https://paydayloanalabama.com/black/ gets paid off for you maybe not a commercial bank and money would be pulled physically out of your paycheck. When you pay-off the loan, you pay it off with appeal. The newest cost amount gets transferred back into your Tsp account and you may was invested considering their latest sum allowance. There is also the option so you’re able to amortize the mortgage as needed so you’re able to alter cost facts such as for example stretching the pay months for 15 years and therefore tweaks exactly how many payments or changes the count.

Why does a tsp loan works?

Loan payments try paid back proportionally out of your conventional and you will Roth balance, and regarding for each and every Teaspoon financing the place you possess assets. Obtaining a tsp loan is easy and there are no denials so long as there can be enough cash in your account. For many who default on the Tsp loan, the credit isn’t affected because although the leftover balance will get nonexempt earnings, brand new standard is not advertised to help you credit reporting agencies. Before you take out a teaspoon mortgage, verify you are not compromising your own a lot of time-name senior years requirements in that way. There are possible monetary implications so you’re able to Teaspoon money, as well as having to delay retirement to help you renew the nest-egg. Tsp levels build through contributions and you may combined desire all of hence try reduced because of the fund removed against him or her. It will always be needed to speak to help you a financial specialist just before taking right out a tsp financing.

While you are underwriting possible income, through the fee from your Tsp mortgage about income analysis and you can budget ahead of time towards payroll deduction. Whether it however is sensible to you personally at all costs together with the mortgage installment, it could be a remarkable chance to fund disregard the functions.

While you are curious about much more about this or other items from passive income, feel free to subscribe ADPI’s Fb classification. You will find lots off tips and you can talks to help provide already been on your way to monetary freedom.