If an offshore supplier makes less than $60k NZD from New Zealand purchases, they’re not required to charge GST. If your client operates outside of New Zealand, with no local presence, you generally charge them GST at a rate of 0% (this is referred to as being “zero-rated”). If you’re unsure about whether your business needs to register, you can contact us or your tax agent.

Officials estimate that the New Zealand gig economy is close to NZ$2 billion (regulatory impact statement, finalized May 25, 2022) so the new measure is likely to add significant new GST revenue. If an overseas business makes more than $60k NZD from low-value goods on New Zealand sales, they’ll be required to register for GST (are you sensing a inktothepeople theme here?). For sole traders invoicing at over $1k, you can’t simplify it – you’re basically still operating according to the old rules and requirements. Using the same example, you send an invoice on the 20th of February, and they pay it on the 20th of March.

- You might need to register for GST if you sell goods or services.

- Especially if your clients are notoriously late in paying their invoices.

- A business must provide receipts to buyers if they’ve been charged GST.

- You can also specify in your quotes whether or not your prices are GST inclusive or exclusive.

Goods and Services Tax (New Zealand)

We’ll also claim GST back for our users when we file their GST returns, so they don’t need to think about the maths how to calculate gross profit margin with example and can get on with the fun stuff. As of the 1st of April 2023, the IRD has introduced new, simplified rules for GST tax invoices. When you register for GST on a payments basis, the date that you recognise the GST on your sales will be the date that you receive the money.

The New Zealand changes come at a time of growing obligations such as DAC7 being placed on platforms globally, emerging information reporting in other countries, and, for some platforms, the impact of payment processing reporting. In relation to VAT/GST, it is vital for regulators to ensure that there is global consistency mental health billing with any VAT/GST rules relating to the gig and sharing economy. A new bill proposes significant changes to the goods and services tax treatment of the gig and sharing economy in New Zealand.

Key Features of New Platform Rules

Businesses operating in New Zealand must register for GST if they have a turnover of more than NZD 60,000 in the previous 12 months, or expect to exceed this threshold within the next 12 months. If a business realises that, based on the previously stated registration requirements, it would not have been mandatory for it to register, it may cancel its registration. Businesses operating in New Zealand that add GST to the price of their goods or services must also register for GST.

GST Guide For Business

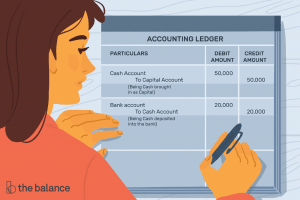

Once you’ve completed all necessary registration processes, you’ll receive a VAT registration certificate within one month. A business must provide receipts to buyers if they’ve been charged GST. Receipts can be used to show the New Zealand authorities that GST has been charged and paid. Xero does not provide accounting, tax, business or legal advice. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided. Financial services, residential rent, and donated goods sold by non-profits fall into this category.

You cannot claim GST for supplies you use privately or to make exempt supplies. As a GST-registered business, you can claim back the GST you’re charged on goods and services you buy and use in your taxable activity. Although the OECD work suggested various options (including educating sellers and information sharing), New Zealand’s draft rules are wide and will be based on a full GST liability model. New Zealand’s closest neighbor, Australia, is opting for an information sharing model, yet to be implemented. Other countries, like Canada, tax platforms in a targeted way (short-term accommodation) and allow certain facilitation fees to be zero-rated. India applies GST to ride shares and food delivery services purchased through apps.

Not adding 15% GST to your prices, and paying your GST bill out of your own pocket. While the cost for your customers won’t change, you’ll effectively be taking a pay cut. And that will stack up over time in terms of revenue lost – especially if it means you have less left over to invest in your business. Whenever you buy goods and services for your business that have GST added, you can subtract the cost of the GST you’ve paid from the GST you need to pay the government.