Sure. They really stands entirely to own annual percentage rate. It is absolutely nothing very state-of-the-art; it simply refers to the overall repayment number for your vehicles financing. It is a tad bit more challenging than just, say, a ten percent cost into an excellent ?ten,000 loan due to the fact material focus is with it.

As you may know this really is a comparatively tricky at the mercy of describe and you will assess for every individual financing you can expect, we’ve made sure that our advisers at each Casual Finance part can handle breaking it off with just minimal jargon. Smaller challenge facilitate and makes it much simpler to help you safe your loan to suit your vehicles.

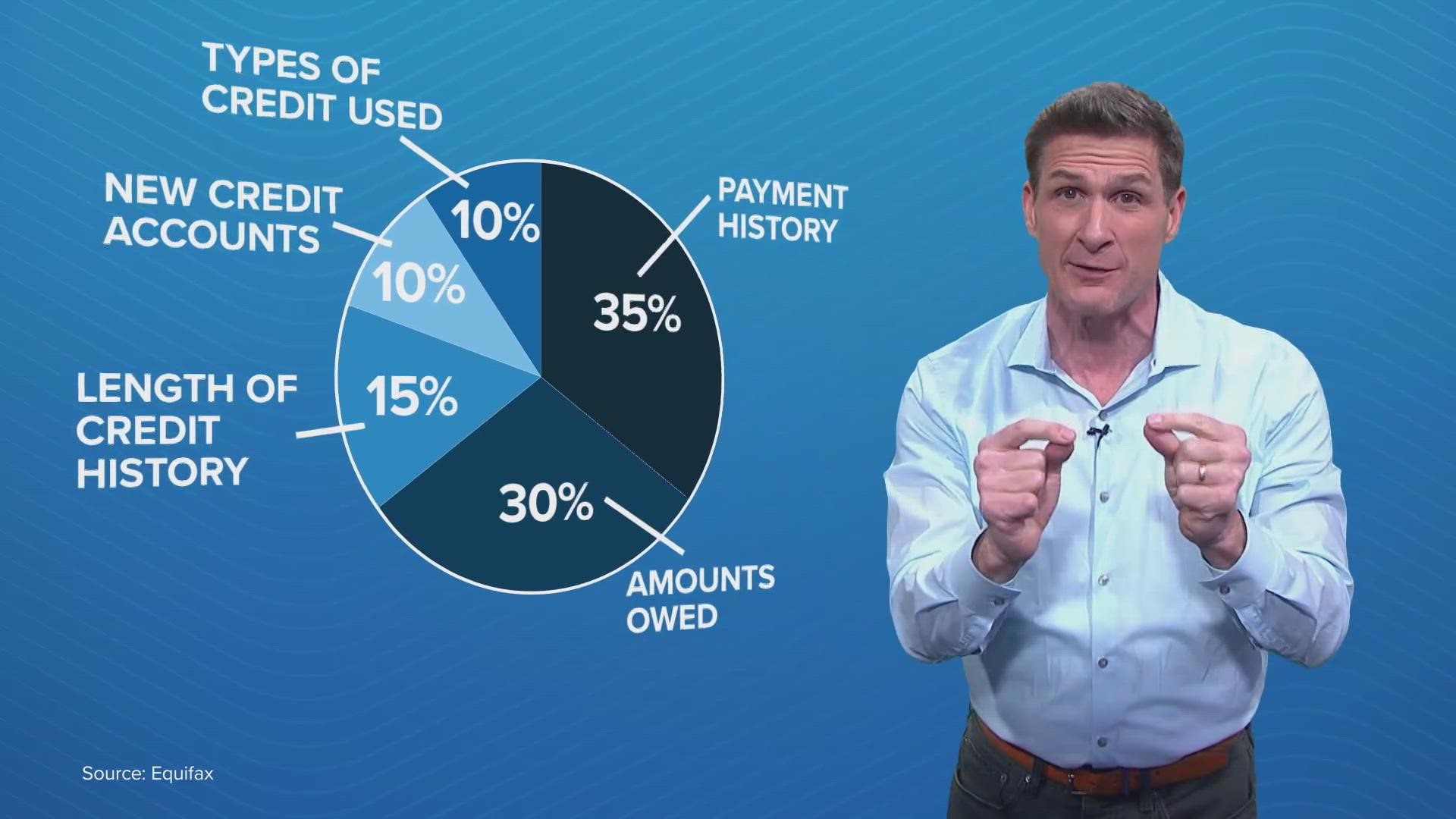

It could manage, but it is not as a result of simply are approved to possess that loan. While we touched into the in advance of, a credit rating is basically an indication from just how financially responsible you’ve been before. Lenders utilize this discover an idea of just how almost certainly you should be properly make money in the future. The good thing? If you make your money and you may over the car financing on time, you will see a growth. This may help you in future various other situations where a beneficial credit assessment required.

Q4: Can it be Ok to make use of a frequent Fund loan to possess a vehicles?

Definitely! I cater particularly for individuals with poorer credit scores and our very own sophisticated funds was very well fine for getting borrowing to fund an automible or even fix you to, especially if you found it difficult to get a loan in other places. Читать далее