Dump these overpriced Silver Plus health insurance policies

Augusta Precious Metals is a gold and silver IRA company committed to delivering an exceptional customer experience. We gather your information and provide you with pre filled forms to open your Silver IRA account with your elected IRA custodian. They also provide excellent customer service, ensuring that all of your best silver ira questions and concerns are addressed in a timely manner. But you’ll have to pay income taxes if you rollover to a Roth IRA. This is one of the most popular gold IRA providers with excellent reputation and zero complaints. Additionally, American Hartford Gold Group provides a secure and reliable platform to store gold and silver investments. We hope this guide managed to answer your burning questions about Gold IRAs and to help you understand whether they are the right option for you. It’s important to note that there are specific IRS rules and regulations surrounding Gold IRA investments, so it’s crucial to work with a knowledgeable and experienced custodian. Grow Your Portfolio with Birch Gold Group Schedule a Consultation Now.

LearCapital com

If you are not an Axis Bank customer, you can get a Service Request Number only by calling us on our toll free numbers. Scott started his career with Advanta IRA in 2006. After going through Kiavi’s prompts investors will be provided with an estimate and the best loan option. The American Hartford Gold Group specializes in precious metal investments, offering a variety of gold, silver, platinum, and palladium products to help investors diversify their portfolios. Portfolio Comparison Calculator. Oxford Gold Group is highly rated due to its expertise in silver IRA investments. GoldCo is a reliable and trusted provider of silver IRA services. You have sole ownership of the gold you buy with a gold IRA and have to eat the extra costs of owning real gold. The agency is ramping up efforts to collect overdue taxes after many debt collection activities were paused in order to provide relief to taxpayers during the COVID 19 crisis.

How Do You Make a Withdrawal from a Precious Metal IRA?

However, with so many silver IRA companies out there, it can be difficult to know which ones are reputable and legitimate. With Advantage Gold, customers can be sure that their silver IRA investments are in good hands. While financial markets can ebb and flow significantly and the US Dollar can devalue over time thanks to inflation, holding popular IRA approved silver in a Silver IRA offers stability in the face of inflation and market fluctuations. Choose segregated vault storage if you have the funds. The same IRA withdrawal rules apply to gold IRAs. Their team of experts are highly knowledgeable and experienced in the silver IRA market, providing clients with the best possible service. Minimum purchase/funding requirements can vary per company, but set up costs, storage fees, and annual fees typically exceed $100 although you’ll pay less in set up costs at some platforms. By selecting a trustworthy lender, you can rest assured that your investment is in good hands and that you’re on the path to a secure financial future. 9% to be IRA eligible.

Making sure you get a fair deal

IRA Nickel Account: 3. There have always been savers and investors want to hold a portion of their assets in precious metals. Their team of experts are knowledgeable and experienced in helping clients make informed decisions about their gold and silver IRA investments. They offer liquidity, diversification, and can be held within a retirement account. Here’s a list of the approved silver bullion for precious metals IRA. Choices for storage include: Delaware Depository Service Company DDSC, Brinks USA, International Depository Services IDS, and others. Why it stands out: Augusta Precious Metals offers gold and silver IRAs, and gold focused investors can take advantage of common gold bullion and premium gold. Also, we do have advertising relationships with some of the offers listed on this website. The Noble Gold Group was founded in 2017 and is one of the youngest but most reputable precious metals IRA companies in the industry. A high loan amount is provided and the repayment tenure is up to 30 years. Please call us today and we’ll help you get started. At Satori Traders, we applaud Investors who perform due diligence before putting their hard earned money at risk.

7 Best CMMS Software of 2023 Ranked and Reviewed

This designation is really based on two sets of criteria one that comes directly from the IRS code governing IRAs and one that comes from the firms that provide storage and IRA custodial services. GoldCo also offers quick and secure gold IRA transfers, allowing customers to quickly and easily move their gold investments. By doing IRA transfers, you don’t have to worry about the 60 day deadline. Investors can even store physical assets at home or in designated bank safes if they prefer not to use Augusta’s storage facilities. Founder and CEO Isaac Nuriani established Augusta Precious Metals in 2012. Store Your Precious Metals Safely with Oxford Gold Group Secure Your Future Today. However, unlike traditional IRAs which focus on paper based assets such as bonds, EFTs, funds, stocks, and other cash equivalents, gold IRAs only hold physical gold or other approved precious metals. The practical concern is finding an IRA trustee who’s willing to set up a self directed IRA and facilitate the physical transfer and storage of precious metal assets. Today, with equity markets at all time highs, prudent investors are taking some of their stock profits off the table and opening precious metals IRA’s to protect and diversify their retirement accounts. There are also penalties if you withdraw funds before reaching retirement age. By electing to utilize the services provided by First Fidelity Reserve «First Fidelity» including making purchases from First Fidelity or making sales to or trades with First Fidelity, you are agreeing to the following terms. However, when you choose to invest with Accuplan, you can get competitive pricing. Regardless of which firm you choose as custodian for your IRA account, we can deliver the physical gold, silver, platinum, and palladium bullion you want – and at great prices. Making a withdrawal from a Precious Metals IRA is similar to withdrawing from other retirement accounts.

Advantage Gold: Pros Best Gold IRA Companies

Ask your Goldco Specialist about current promotions as Goldco may reimburse you for these annual fees. In conclusion, investing in gold and silver through a reputable gold and silver IRA company is an excellent way to protect your retirement savings and diversify your portfolio. If you haven’t already opened a silver IRA, you are wasting too much time. This is crucial in the gold IRA market, where many scammers are trying to exploit investors. Patriot Gold Club: A Guide to Secure Your Financial Future. When choosing American Hartford Gold for your gold IRA needs, you’ll be getting top quality advice and guidance along with some of the most competitive fees in the industry—not just on gold but on other types of investments too.

GoldBroker: IRA Accounts – Gold and Silver IRA

Fernando Hierro 1/10th oz Gold Coin 2023Contact Us. The IRA can then sell, audit or physically withdraw/ship the metals to another depository at anytime. When people lost their retirements in the 2008 stock market crash, not only did those invested in gold not lose money but they even made incredible gains. Unlock Exclusive Benefits with Patriot Gold Club Join the Top Tier of Gold Investors Today. An IRA custodian is a financial institution responsible for the assets within your IRA. Please note that the lifetime RMDs exception does not apply to Roth source amounts in your retirement plan.

American Hartford Gold: Cons Gold IRA Rollover

Their CEO has been quoted across top financial media and news outlets, and they’re known for transparency, professional staff, and reasonable pricing. Choose a custodian and fund your self directed IRA account tax free. Gold — the Egyptians coveted it and the Romans were the first to use it as the basis for their monetary system. Don’t wait for inflation to completely devalue your dollars. If you would like assistance, please call Money Metals Exchange at 1 800 800 1865. BullionVault won the UK’s prestigious Queen’s Award for Enterprise 3 times: for Innovation in 2009 and International Trade in both 2013 and 2022. There will not be any tax penalties for a transfer. No matter which gold IRA company you choose, it’s important to do your due diligence and research each company thoroughly before making a decision. GoldBroker: Your Ultimate Destination for Precious Metals Investment. Cheng, CFP®, CRPC®, RICP®. Past investigations of similar schemes revealed no physical metal was ever purchased on behalf of customers, but they were charged interest, margin, storage, and insurance charges. With this in mind, a provider that can offer educational resources such as videos, tutorials, e books, and easy to understand blog posts stands out as a top choice for beginners. The customers of Augusta Precious Metals not only enjoy low costs but also know exactly how much they are paying and for what.

Oxford Gold Group: Summary Gold and Silver IRA

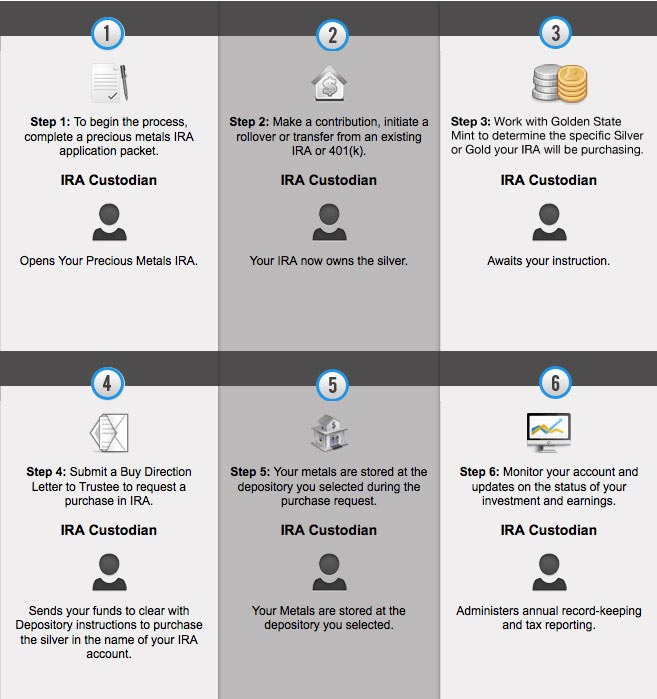

Silver, Gold, Platinum and Palladium. DollarGeek strives to keep its information accurate and up to date, but makes no guarantee. Investors looking for short term investments i. By submitting this request you confirm that Rosland Capital may send you the free information checked above and that you are expressly authorizing Rosland Capital to contact you at the email address and/or telephone number above, including a cell phone, irrespective of whether or not such telephone number appears in any state or national Do Not Call registries. American Hartford Gold will meet or beat any competitor’s price. It is also important to make sure that the broker or custodian is properly licensed and insured, as this will help protect one’s investments in the event of a problem. United Gold Direct operates out of California and has worked in the precious metal industry for over 25 years. You can follow these three steps to open your precious metals IRA.

Cons

You will deposit the funds into your SDIRA in preparation for investing. This is imperative to maintain a tax advantaged status. Please read our article, «Beware of Home Storage IRAs» to equip and protect yourself and your retirement savings. Augusta precious metals website has a secure form you can fill out. The IRS regulates and controls the products that can be added to your precious metals backed IRA. Only if you’re buying specifically for inclusion in an IRA. They also have a complimentary storage program for non IRA precious metals. ✅ Free Transit Insurance and Shipping: For qualified orders, Augusta provides free transit insurance and shipping, giving investors peace of mind that their investments will arrive safely. Individual Investors: Book a meeting. You will then need to fill out the necessary paperwork and transfer funds from an existing retirement account or make a contribution to the new account. IRA Silver Account: 0. 2020 has been a very volatile year, forcing many investors to seek safer investments such as precious metals.

New Silver

With their silver IRA services, Noble Gold ensures that customers can confidently invest in silver as part of their retirement portfolio. Why it stands out: Noble Gold doesn’t only offer access to gold, it also provides silver, platinum, and palladium. Additionally, many companies also impose ongoing fees and/or commission charges associated with maintaining these accounts – so it’s always wise to research any potential costs ahead of time before committing to anything. In other cases, a dealer might call a customer and report that she ran into the company’s lead trader who gave her a tip that the metal is about to take off in value. With years of experience in the industry, Noble Gold provides clients with a reliable and secure way to invest in precious metals. To achieve this goal, Lexi Capital provides new investors with account managers who develop personalized portfolio plans. By: Paradise Media LLC. Internal Revenue Code requirements state that the approved precious metals must be stored in a specific manner. For precious metals, the only way you can profit from them is if you sell them to someone else. But anyone considering this «self storage IRA» scheme should be extremely careful and aware of the risks. Customers can trust that their gold and silver IRA investments are safe, secure, and reliable, making Augusta Precious Metals an ideal choice for gold and silver IRA investments. Public Alert: Unregistered Soliciting Entities PAUSE Table. Once you’ve filled out the required paperwork and opened your account, you’ll need to fund the account details on that below, choose which gold and other metals you want to invest in only certain ones are eligible, per IRS rules, and then direct your account custodian to purchase the metals on your behalf. GoldStar Trust Company, a leading IRA custodian, and DDSC Delaware Depository are the two latest institutions to add the.

Political Context

Join the Patriot Gold Club for an Unforgettable Experience. Gold IRAs can be an excellent option if you decide to diversify your retirement portfolio and protect yourself against economic volatility. Weight: 1 Kilo Fineness:. However, there are specific rules regarding the types of gold and precious metals you can invest in with a self directed IRA. Harness the Strength of Gold Alliance. You can also check out our guides for the best retirement plans, the best traditional IRAs, and the best Roth IRAs. With just a small portion of your wealth invested in gold, silver, palladium, and platinum, the exact amount which shall be discussed later, you can cast a safety net wide enough to protect most of your wealth from inflation. Gold American Buffalo.

CONS

If you are coming up on retirement, you’ll want to take fewer investment risks and may not want a large portion of your money in gold. This is modest in the gold IRA industry where some companies have account minimums as high as $50,000. There are many gold and silver IRA companies out there, so it is important to do your research to find one that is reputable and has low fees. None of our partners or advertisers have editorial input or control because our relationship with our readers always comes first. If this happens, people will look for a safe place to hoard their money. Most people, whether seasoned or new investors, do not have the time to dedicate hours every week trying to keep up with how their Individual Retirement Account investments are doing and because of this, investors are always looking for new and smart investment options that will make their lives easier. You sell your metals and funds are returned to your custodian. Your financial advisor will help you decide whether gold will take you where you would like to go before reaching out to a specialized gold IRA company to take the next steps to make gold purchases.

Hedge against the declining dollar and money printing policies

Precious metals IRAs are not one size fits all investments. Unlike other precious metals, IRA companies such as Birch Gold Group and American Hartford Gold, Goldco fees are amongst the lowest you can find. Their experienced professionals are always available to answer any questions and provide guidance throughout the process. Our Coin Advisors specialize in constructing balanced and diversified hard asset portfolios with a strict focus on safety, security, and privacy. Accurate Precious Metals Coins, Jewelry and Diamonds can assist in establishing Gold or Silver IRA accounts that allow individuals to store physical bullion coins/bars instead of paper assets as part of their retirement plan. Our knowledgeable associates aren’t just specialists in the field, they’re also more than willing to provide world class customer service. Many experts predict the price to reach up to $30 in 2021, which is a 52% return on its current price. Attractive gifts with each subscription. 3601 North Market Street,Wilmington, DE 19802302 765 3889. In some cases, you may need to pay a fee, as with a certified nonprofit credit counseling agency or if you hire an attorney.

Stock Ideas

The company offers a secure and convenient way to invest in gold, with knowledgeable advisors and competitive pricing. With Advantage Gold, customers can rest assured that their gold and silver IRA investments are in good hands. We are uniquely poised to help retirement savers avoid the complications, errors and high costs inherent in other precious metals IRA programs. Some of the company’s perks include no fees for the first year of the account, no storage fees, and a great selection of coins. Additionally, a custodian can provide valuable guidance and advice on managing your gold IRA investments. Their customer service is top notch and they have a strong reputation for being reliable, trustworthy, and knowledgeable. Starting a Gold IRA can be easy or tedious depending on the Gold IRA company you choose. Consequently, the value of gold and silver will increase. If you have questions, just call 1 800 928 6468 to speak with one of our qualified IRA Advisors.

Anna Miller

They operate in total transparency, recognizing the value of IRAs and making suggestions based on their benefits to customers. The company has achieved unprecedented success by teaching its customers, setting it apart from its rivals. In terms of price, it will be close to the most recent market value. Gold IRAs allow investors to hold gold as a retirement investment. All investments carry risk. Responsive and quick to return calls. Below are the general rules that all precious metals should fulfill for use in Gold IRAs. Advantage Gold is an industry leader precious metal dealing company located in California. You must consider the delivery time of the gold IRA company you want to invest with. It looks from this example the investor paid a higher premium for the silver proof coins over the gold proof coins, more than twice the spot price of silver. If You’re Looking to Diversify Your Investment Portfolio, Look No Further Than Noble Gold. Regularly tracking the performance of your IRA should help give you confidence that your funds are secure and performing as expected. Join the Patriot Gold Club for Unbeatable Benefits. 8566; Florida Mortgage Lender License No.

Advertising

Keep in mind that storing precious metals at home is strictly prohibited. The IRS does not let you self store IRA gold at home. Investing in a gold and silver IRA involves purchasing physical gold and silver coins or bars, which are stored in a secure facility. Their commitment to customer service and their thorough knowledge of the gold IRA industry make them one of the best gold IRA companies. Review them to get an understanding of how an account can be started to help you build wealth in retirement. For new investors looking to enter the Gold IRA market, American Hartford Gold makes it easy for you to understand how the Gold market works by providing you with a wealth of information through blogs, free beginner guides, FAQs, current market prices, and market news to help you make an informed decision. Overall, their goal is to make the process as smooth as possible for customers. Their commitment to customer service and quality products make them a top choice for gold and silver IRAs. The best choice would be the company that can return your order within days to a maximum of one week with less downtime, and they ensure you will save time waiting for the order to be cleared. Copyright © 2023 Secure your Retirement 2023. Augusta Precious Metals is committed to providing the best gold IRA experience possible, making them one of the best gold IRA companies available. Decide What Kind of IRA You Want: Although most investors will choose a traditional gold IRA, others may opt for a silver or even platinum/palladium IRA. And Forbes magazines.

Our Services

Check out These Articles. Best Company for Great Gold IRA. Remember that not all gold and silver pieces may be utilized in an IRA due to certain IRS regulations. The job of the experts at silver IRA companies is to do what they can to make the process as stress free as possible for clients. Augusta Precious Metals is a trusted firm that has earned five star ratings and awards for its excellent service. By entering your information and clicking Download Guide, you consent to receive reoccurring automated marketing text messages and emails about Equity Trust’s products and services. Your precious metals IRA is connected to an IRA custodian that manages the entries of the logbook and a depository vault where the actual assets are stored. Discover GoldCo’s Exceptional Service Today and Experience the Difference.