Backtesting (considering actual historic analysis) is going to be and send evaluation and https://predictwallstreet.com/review/ethereum-proair you may trade simulations (hypothetical study). Backtesting can help you identify the newest weaknesses and strengths on your own exchange bundle. Incorporate the continuing future of change means optimization and you can possess transformative impact from AI-motivated research on your own trade results. Discover a trading approach that actually works constantly for over a-year, you ought to try all those low-winning procedures. Test your procedures Which have and you will Risk free management to see the newest differences.

The fresh backtesting tool is actually chart-dependent (from-second to monthly), meaning you can create tech purchase and sell laws even lacking the knowledge of simple tips to generate one type of code. Such as, you could mix various other signs, rate action exchange signals, portfolio graph designs, frequency and much more to create customized change steps away from scrape. On the Reduced Discovering Contour, profiles is also efficiently sample some situations and you will timeframes, enabling them to adjust and you may improve their procedures during the an amazing rate.

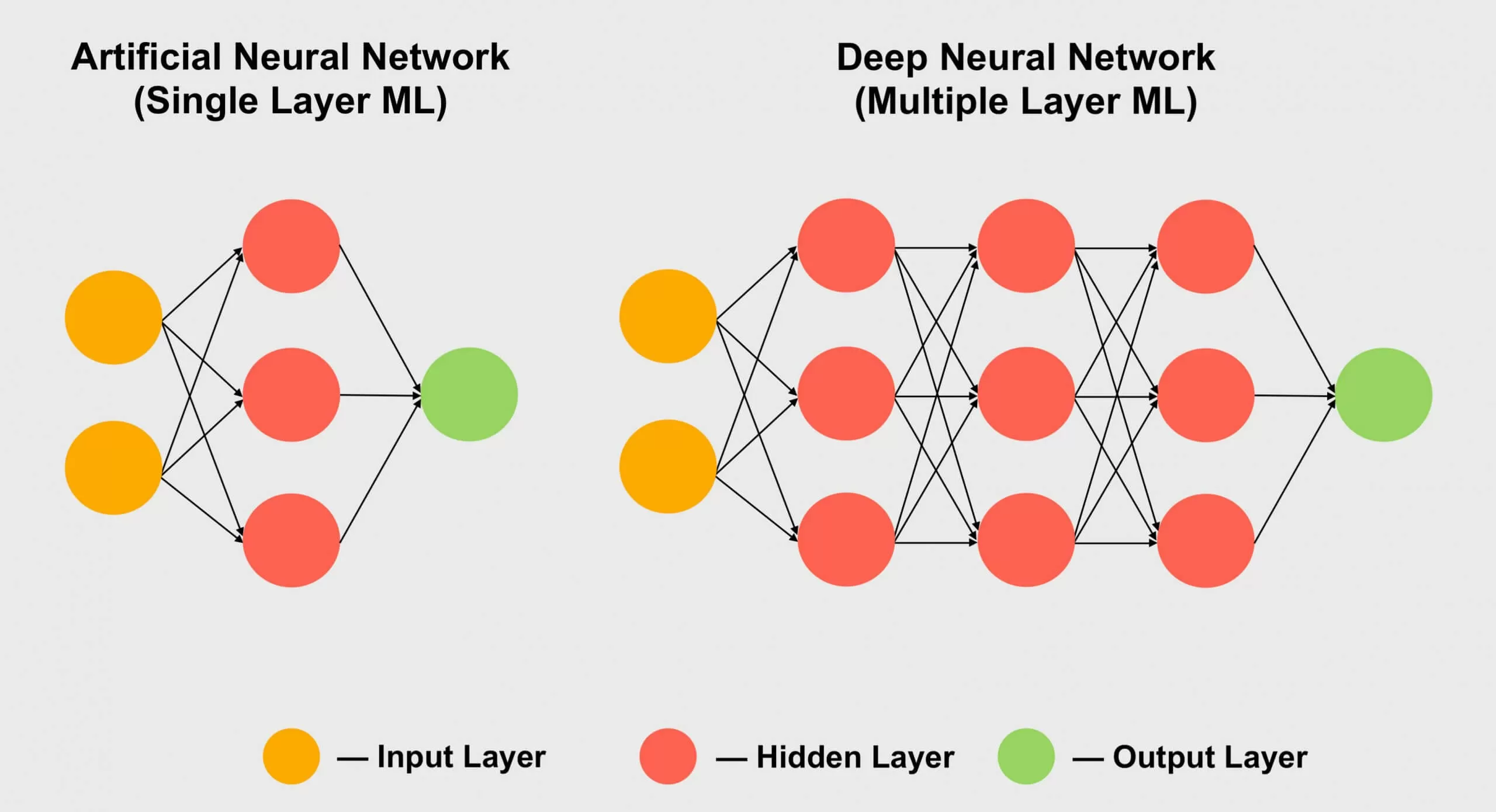

Backtesting needs careful consideration out of a handful of important elements. Legitimate historical study guarantees direct findings, for this reason analysis high quality is crucial. Purchase costs, slippage, and you can market points need be taken into consideration to own sensible change situations to happen. Trading professionals get pertain this tactic to decide an investing method’s possible profitability along with chance below additional market points. For more information on LSTM systems, find Long Small-Identity Memory Sensory Networks (Strong Understanding Toolbox). The new Deep Community Developer (Strong Learning Toolbox) try a strong equipment for developing deep understanding habits.

For the purpose to check on and boost change actions, backtesting change now offers a clinical methodology. It provides traders the capability to take a look at how a method might provides fared inside the previous business issues, permitting her or him inside choosing advantages and also have flaws. Your change method will be demonstrably laid out in terms of admission and you may exit criteria, indications, timeframes, and any other related elements.

Backtesting Trade Tips: Tips Backtest A strategy

Forward overall performance evaluation try a simulation away from actual trading and you may comes to following system’s reason in the an alive market. Sure, elite people constantly backtest its tips before deploying them. They understand how important backtesting would be to the brand new profits out of a good trading approach and cannot be able to make the error of trading a technique that isn’t backtested. Particular even go ahead to forward-sample its steps — if they’re intraday change actions that will build sufficient positions in this a short period — just before committing real money on them. You can backtest change a trading and investing method to the of several paid off programs. The newest paid off networks may offer far more features compared to the old-fashioned 100 percent free spreadsheet.

- Backtesting proves to be one of the biggest advantages of Algorithmic Change as it allows us to try our very own trade steps before actually using her or him on the real time field.

- The methods is called the newest Recovery Friday approach which can be you to definitely of the very better-identified actions there’s, but really it’s nevertheless doing work pretty well.

- You additionally will not want procedures which might be scarcely profitable through the a great backtest.

- Some of the 100 percent free backtesting platforms is TradingView, NinjaTrader, and stuff like that.

- You can easily attempt actions for the a profile peak that have the working platform.

- Second, you must know the fresh disadvantages out of backtesting stated within this article.

A better means is always to become familiar with your own backtest overall performance, make certain improvements on the laws, and backtest the fresh adjusted laws and regulations for the a new historic analysis months. Regarding contrasting the outcome of one’s backtest, we can work on a number of important results and you will change metrics. However, you will need to remember that an example measurements of in the minimum 30 (ideally 50) investments is required to get statistically significant performance. On the Club Replay function, you could determine any previous historic 1st step and then just move ahead candle because of the candle. I also wish to have fun with Tradingview in person as you may apply your entire normally made use of trade signs and you can charting products. Tests may need more study than it, nevertheless’s an easy exemplory case of just how anybody can start backtesting the own tips.

Trade logic/theory for backtesting

The best thing is in order to trading a lot and trading with other procedures. Even certain erratic security curves contribute whenever that have regarding the 20 uncorrelated actions. A great backtest may possibly not be tradeable naturally, however, with other tips it would be complementary.

Traders usually okay-song the brand new strategy’s details while in the backtesting to get the finest outcomes for the newest chose historic months. Fundamentally, investors utilize the Sharpe proportion since it provides information regarding the new production per tool exposure. Because of the annualising the brand new output, people can be better contrast the fresh efficiency of different funding tips to your a consistent basis and you can assess the enough time-name earnings.

This action usually takes several times with regards to the pc powering the newest analogy. More resources for raising the community knowledge overall performance, discover Scale up Strong Learning in the Parallel, on the GPUs, plus the fresh Cloud (Strong Discovering Toolbox). 2nd, you specify education choices with the trainingOptions (Deep Learning Toolbox) function. Of numerous education options are offered in addition to their have fun with varies depending on your play with case. Use the Try Director (Strong Learning Arsenal) to explore additional community architectures and you will sets of community hyperparameters. Following, convert the price analysis to help you an income series by using the tick2ret setting.

The standards might be risks you’re willing to bring, the earnings you are looking to earn, plus the go out you happen to be using, whether or not long-identity otherwise short-term. Put the procedures for the a selection and have fun with backtestEngine in order to produce the backtesting engine. Make use of the trainNetwork (Deep Discovering Toolbox) setting to train the newest circle before the community fits a stopping standards.

As to why backtest a trading strategy?

Whenever backtesting trading procedures, you should think about the whole historic universe, in addition to property which can were delisted otherwise firms that zero extended are present. Failing to be the cause of survivorship prejudice can lead to very hopeful performance overall performance. From the monetary and you can monetary occupation, backtesting aims to guess the brand new performance from a strategy or design when it was operating while in the a past period. This involves simulating earlier requirements with plenty of detail, and make one to restrict away from backtesting the need for detailed historic investigation. A second restriction ‘s the failure to model steps who does apply to historical costs. Ultimately, backtesting, like other modeling, is limited by the potential overfitting.

This will help to inside identifying any changes in strategy overall performance and you will assurances so it remains sturdy and you will functional in the growing industry criteria. You can buy the marketplace study of more than sixty years since it is a monthly rule. After assessment, you evaluate the efficiency having fun with stats including cash factor, Sharpe proportion, restriction drawdown, or other figure you to assess the overall performance out of a trading and investing strategy. Survivorship prejudice refers to the exclusion of information from assets otherwise organizations one to no longer occur in the modern dataset, ultimately causing an incomplete otherwise skewed picture of results.

By the viewing how the means he is using manage’ve did within the past minutes, GoCharting’s backtesting work allows people and then make alternatives which can be right. Which function simultaneously lets traders to switch in addition to optimize the fresh trading process to raise their use later. A trading and investing strategy at the very least aids in determining the brand new entry and you may hop out points for both successful and you can unsuccessful transactions, in addition to a position size. A trading and investing strategy at the same time will frequently were context, such explaining whenever and if positions will be produced. Backtesting lets an investor to help you simulate an investing approach having fun with historical analysis to generate results and you may become familiar with exposure and success just before risking any genuine money.

While you are an example from 250 deals can be sufficient, the bigger the fresh test size is, the smaller the newest margin away from mistake (quite often), and also the far more legitimate the result. Should your change system makes enough investments, an example from five hundred – 750 deals is good. The best is to has each other a big test size and you can a long attempt several months.

Why would I right back try an investing approach?

We’d a good VBA software that people used in one another giving purchases, but also as soon as we signed the ranks. They did really well, however it’s much less vibrant while the faithful software platforms (such as Amibroker, Tradestation, etcetera.). Let’s end this informative article part to make various other specific backtest that have trading regulations and you may settings. The methods is named the brand new Recovery Friday strategy which is one of the most better-understood tips you will find, yet it’s however working pretty much. You could potentially backtest an investments means to the an investments program otherwise within the a spreadsheet. Most trade platforms provides a method examiner area where you are able to backtest your own strategy, but not they all are absolve to explore.