Private home loan insurance rates (PMI) is the necessary insurance borrowers need to pay into conventional lenders in case they stop and then make costs. The fresh new PMI is actually set in the month-to-month financial costs. Sooner or later, the brand new PMI covers the financial institution away from prospective losings. Individuals whom spend below the traditional 20 percent downpayment into property are thought riskier as they have less «facial skin on the video game,» as they say.

Regarding the 60 percent regarding very first-time home buyers has actually PMI as well as the mediocre amount borrowed that have PMI is roughly $260,000, predicated on study off U.S. Mortgage Insurance companies. You may also play with a beneficial PMI calculator to help you guess how much you will be charged.

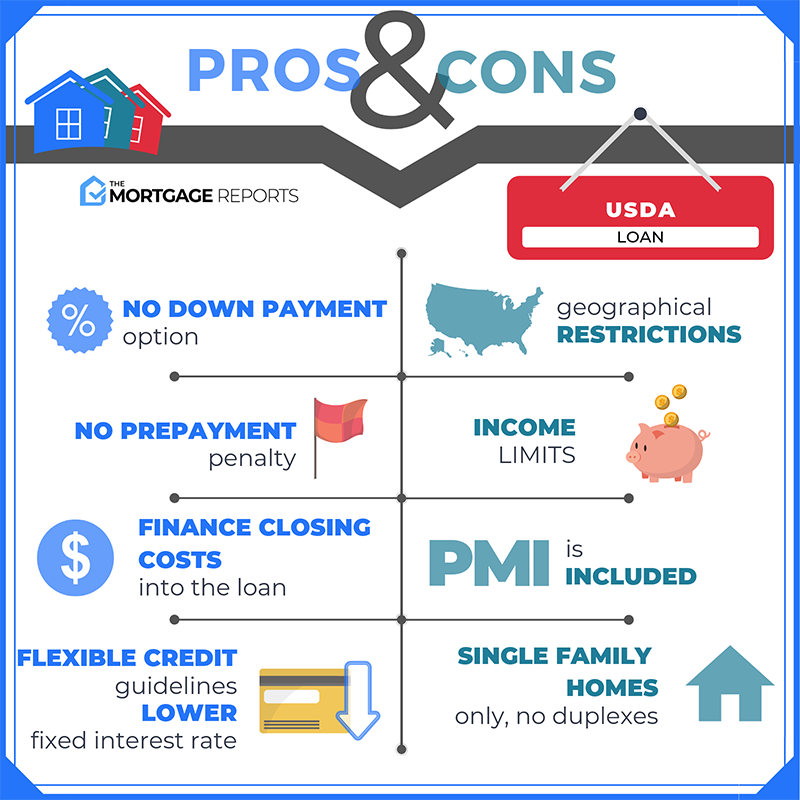

It’s hard to quit PMI. PMI is sometimes viewed as an important cost because it’s the fresh superior property owners spend, (based on credit score and you may loan details, between .20 to a single.5 %), not to have to generate a large chunk of currency purchasing a home. The borrowed funds financial chooses the latest PMI and it is not necessarily effortless so you’re able to terminate PMI when the time comes.

But the good news are PMI is a lifesaver so you can let attract more earliest-date home buyers in your house of the goals having while the little as a good step three % downpayment. Whether you’re seeking to set out origins within the a home otherwise re-finance their financial, Legitimate can help you compare also provides away from several lenders on just after discover that loan imagine toward ideal pricing.

cuatro an effective way to cancel PMI

Cancellation associated with the extra commission is tunes for the ears while you are currently purchasing PMI or try a potential homebuyer obtaining pre-recognized and you will learning what type of mortgage is great getting you. Sure, to the best standards, you might eliminate the individuals annoying PMI repayments from your home loan due to the fact they don’t have in order to past the whole longevity of the mortgage.

Ditching the fresh PMI payment is the best for those who have more 20% security of your home. Never wait for the bank to reach out over you to definitely start this cancellation. Speak to your bank and you can let them know exactly how their collateral has actually xxx. Your bank account have to be within the good position having toward-time payments while are unable to have liens such a good household equity financing.

step 1. Refinance

Refinancing you reside one method to stop PMI payments (and it is a particularly wise time for you to re-finance provided the current mortgage rates). Explore Credible’s totally free refinancing product to analyze more lenders so you’re able to find the best cost today.

Mortgage refinancing work especially high if you’re during the an area where home values has increased adequate to make you many guarantee during the an extremely very little time. In case the remaining harmony in your mortgage are below 80 % of one’s home’s value, then you’ve got essentially «free’d» your self on PMI.

2. Up-to-date appraisal

Perhaps you have gathered enough collateral of your home to place your more than one 80 % threshold and do not even know it yet. Say you’ve made extensive home improvements by remodeling or the home’s well worth ran right up compliment of neighborhood developments, your financial will believe a special appraisal for deleting new PMI.

Have a look at on the internet home sites observe just what similar residential property is attempting to sell to possess towards you after that get an appraisal for people who imagine it will help cancel PMI. An appraisal might be evidence toward mortgage lender that the home has significantly more collateral with no prolonged requires the PMI. Score rates of various appraisers and make sure he could be registered and you will authoritative.

step three. Lower their mortgage reduced

Since the PMI is dependant on the total amount you may have leftover to blow on your financing, if you’re able, it’s a good idea personal installment loans in Riverside to expend down your own financial quicker versus booked matter. You can do this by simply making a lot more payments monthly (all little bit helps, actually $40-$fifty a lot more), or as your profit create. Earmark particular costs to go to prepaying for the the main harmony. All of this really helps to make equity smaller and you may eliminate the PMI repayments.

4. Anticipate scheduled cancellation

Once your financing is scheduled to-arrive 78 % of unique worth of your house, otherwise when you’ve attained brand new midway draw on your commission bundle, by law, the lending company is required to automatically cancel PMI monthly premiums. Some lenders can perform so it during the 80 %, however, fundamentally simple fact is that lender’s solutions.

Look at your loan data otherwise get hold of your financial to ascertain the PMI termination time so you can make a record.

What’s the Homeowners Safeguards Work?

Labeled as the fresh PMI Termination Work, the home owners Protection Operate from 1999 is applied to help you manage borrowers of excessive PMI coverage. Possibly consumers experienced times when the financial institution refused to cancel PMI, even after fulfilling minimal standards. The fresh new FDIC cards one to prior to the act property owners got restricted recourse for it condition.

Now, the latest work handles homeowners by prohibiting life of loan PMI visibility to own debtor-paid PMI services setting up consistent tips on termination and you will termination away from PMI formula, with regards to the FDIC.

Troubles investing PMI?

If you find yourself having problems seeking to cancel PMI, you will need to understand your rights. Be sure and keep a papers trail of the correspondence (calls, letters, emails whenever submission termination consult) along with your bank concerning your PMI. Due to the fact a homeowner, whether your bank will give you dilemmas or seems to be hauling its ft for the cancelling their PMI, you might fill in a complaint on Consumer Financial Coverage Agency.