For example, in the first month, about $1,000 of the $1,432.25 would cover interest, while $432.25 reduces the principal. Over time, as the principal decreases, the interest portion of each payment diminishes, and more is applied to the principal. By the end of the loan term, the entire loan balance will be paid off, and the borrower will no longer have any debt. By expensing the cost of an asset over time, businesses can reduce their taxable income, leading to potential tax savings. This can improve cash flow and provide additional funds for reinvestment and growth.

- This means that each monthly payment the borrower makes is split between interest and the loan principal.

- You can insert new columns, and Excel will preserve the table formatting.

- “Mortgage loan amortization” is the process of paying a home loan down to $0.

- You might also be considering prepaying your mortgage, such as making biweekly payments instead of paying once a month.

- Alternatively, speak to your accountant or financial advisor, as they will ensure your amortisation calculations are accurate and correctly recorded in your financial statements.

- Before deciding on a mortgage loan, it’s smart to crunch the numbers and determine if you’re better off with a long or short amortization schedule.

Rate

- A shorter amortization period means higher monthly payments but less interest over time.

- Negative amortization is when the size of a debt increases with each payment, even if you pay on time.

- This is especially true of fixed-rate loans, because the interest rate generally stays the same, while the principal balance steadily decreases over time with regular payments.

- The concept of loan amortization lies at the heart of debt repayment, serving as a guiding principle in the process of returning borrowed funds to lenders.

- Amortization works the same way on a mortgage compared to a personal loan.

- However, understanding exactly how your mortgage payment is constructed is a good idea.

The IRS has schedules that dictate the total number of years in which to expense tangible and intangible assets for tax purposes. A simple-interest loan is a fixed-interest loan that charges interest only on your remaining principal balance — meaning you won’t pay interest on the interest that’s accumulated. While amortized loans, balloon loans, and revolving debt—specifically credit cards—are similar, they have important distinctions that you should be aware of before signing up. The amount of principal paid in the period is applied to the outstanding balance of the loan.

Example of a Loan Amortization Schedule

Common uses include debt consolidation, home improvements, education, starting a business and covering large unexpected medical expenses. Amortization refers to the amounts you pay back each month (as well as the total term of the loan) for both the principal amount of the loan and the interest being charged for borrowing. One relates to loans (like a mortgage) and the other to the depreciation of an intangible asset. When you pay your home mortgage over time through monthly installments, you are paying both the interest and the principal. You pay different amounts to each depending on the date of each accounting equation explanation payment, but by the end of the loan term you have paid off both the interest and the principal.

Fixed-Rate Mortgages

Some of the offers on this page may not be available through our website. The interest rate you pay is calculated as a percentage of the original amount you borrowed and can vary based on your credit score, credit history, the amount borrowed and other factors. In the first month, $75 of the $664.03 monthly payment goes to interest. Accountants use amortization to spread out the costs of an asset over the useful lifetime of that asset. Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site.

How To Know Which Debt To Pay Off First

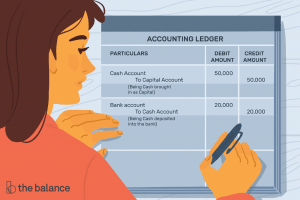

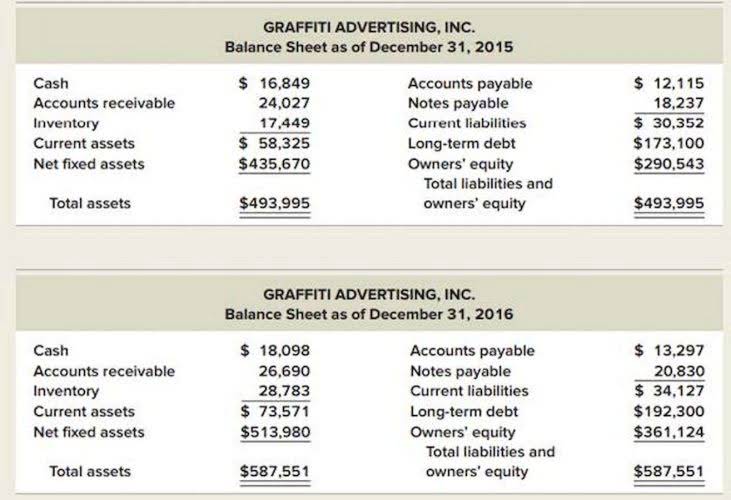

The amortization schedule is a table delineating these figures across the duration of the loan in chronological order. Borrowers who fall behind on their home or car loan payments could experience negative amortization. With negative amortization, the loan’s outstanding balance grows larger instead of smaller. Sticking to your loan repayment schedule will avoid negative amortization by paying off each month’s principal and interest charges.

Payroll reporting

For this reason, monthly payments are usually lower; however, balloon payments can be difficult to pay all at once, so it’s important to plan ahead and save for them. Alternatively, a borrower can make extra payments during the loan period, which will go toward the loan principal. Loan amortization determines the minimum monthly payment, but an amortized loan does not preclude the borrower from making additional payments. Any amount paid beyond the minimum monthly debt service typically goes toward paying down the loan principal. This helps the borrower save on total interest over the life of the loan. Your lender might share your amortization schedule so that you can see exactly how each monthly payment you make is applied to the outstanding balance you owe.

But rather than pulling out your own calculator, click here to leverage our loan amortization calculator, which simplifies this process significantly. Here’s a brief overview of how these calculations work and how our calculator can assist you. In the most basic sense, amortization is the process of spreading out a loan into a series of fixed payments over time. To navigate this perilous terrain, borrowers are advised to make larger payments, thereby mitigating the risk of negative amortization and hastening the path to debt freedom. Consider, for instance, the plight of a credit card holder making only the minimum payment each month. If this payment falls short of covering the accrued interest, the outstanding balance may swell, perpetuating a cycle of debt accumulation.

The amount of the loan, the rate of interest, and the term length determine the amount of each payment. Additionally, amortization aids in budgeting and planning, prior year products providing a predictable expense schedule that can support strategic financial decision-making. With clearer insight into asset value and costs, businesses can make more informed choices regarding investments, financing, and overall resource management.

Amortization tables help you understand how a loan works, and they can help you predict your outstanding balance or interest cost at any point in the future. The loan amount refers to the total sum of money that a borrower receives from a lender. It is the initial principal balance of the loan before any interest at what income does a minor have to file an income tax return or fees are added. Knowing your loan amount will help you calculate your monthly payments and repayments over time. The structured approach of loan amortization provides clarity on how payments are allocated between interest and principal over time.